Precisely what do FHA and you may USDA Loans Have commonly?

You don’t have to build an advance payment for individuals who be considered for a great USDA financing. You are going to need to pay a funding percentage, and this acts as insurance coverage. The degree of the cost may vary but cannot be far more than simply step 3.5% initial and you can 0.5% of one’s average yearly outstanding harmony month-to-month.

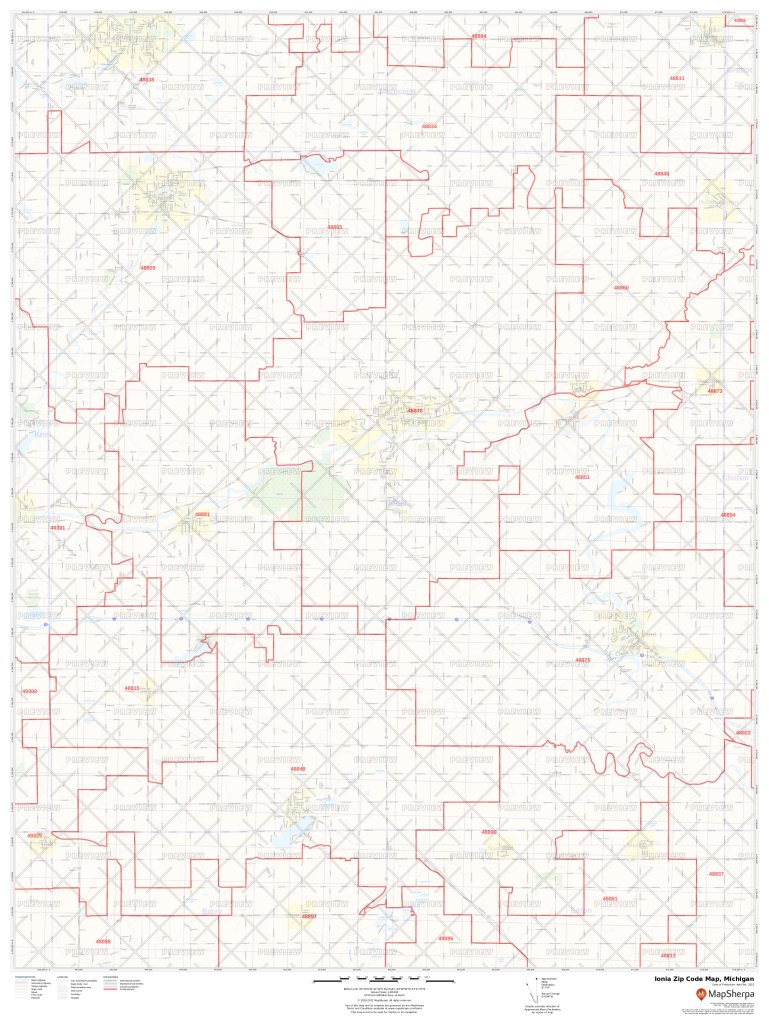

USDA financing borrowers must meet money conditions, and this differ in accordance with the the main nation where they are interested to buy a house.

When you are USDA and you will FHA loans has their distinctions, there’s certain convergence between the two mortgage software. Some of the possess the fresh new financing have commonly become:

step one. Authorities Be sure

Both FHA and you will USDA financing are guaranteed by the bodies. However, the fresh firms one to guarantee the money disagree. The fresh new FHA provides insurance policies having loan providers just who participate in the new FHA loan system, once the USDA backs USDA finance.

The government be sure things whilst provides lenders reassurance. When a lender items financing, it wishes specific support you to definitely a borrower have a tendency to pay it off. To track down that support, loan providers examine borrowers’ credit scores, income and you may property. Basically, the higher another person’s credit history and you may earnings additionally the a great deal more possessions he’s, the brand new safer they look to help you a lender.

A borrower whom has no a top credit history, big money otherwise enough property may still be able to shell out its mortgage as decided, however, a lender might hesitate to approve her or him. When it comes to either a beneficial USDA financing otherwise FHA financing, an authorities department are stepping into bring an additional covering out-of defense to your lender, minimizing its chance.

The federal government make certain cannot been absolve to individuals. In the example of each other a keen FHA and you may an effective USDA loan, new debtor has to spend mortgage insurance premiums to purchase cost of the agencies’ guarantees.

2. Accessibility to help you Buyers Which Might have Complications Being qualified to many other Mortgages

Several other ability FHA and USDA money have commonly would be the fact both are available to homeowners just who may not be eligible for other version of mortgage loans. The newest FHA financing system is supposed to have consumers who possess expert, decent or reasonable fico scores and you can who aren’t able to make a giant advance payment. Such buyers have attempted to submit an application for traditional mortgage loans but was basically rejected.

The new USDA loan program is actually for consumers during the rural otherwise residential district components who might not have enough earnings so you’re able to qualify for some other version of mortgage and you can who don’t have the down-payment available having an FHA mortgage.

step three. Fixed Rates of interest

One another USDA and you will FHA mortgage programs offer consumers fixed rates. A fixed interest rate stays an identical on mortgage label. By taking aside a keen FHA home loan having a 3.85% price, you’ll shell out step 3.85% for the big date you to and on the very last time.

There are several positive points to providing home financing which have a predetermined rate. You always know very well what your own monthly installments is if rates is actually ongoing. Delivering a home loan with a predetermined rate including allows you to secure for the an increase while they are lower, without worrying that it’ll escalation in the near future.

Having said that, adjustable-price mortgages (ARMs) have rates of interest one changes into the a flat agenda, eg all the 36 months. The rate on a supply normally jump 1 day, improving the measurements of the month-to-month mortgage repayment.

What is the Difference in FHA cash advance in Five Points and you can USDA Financing?

If you find yourself there are lots of parallels when comparing USDA funds versus FHA of those, the brand new mortgages come from several collection of programs. There are more famous differences when considering FHA and Outlying Innovation financing.